Contents:

The body of the second candle fully contains the first candle, which completes the shape of the bearish Engulfing pattern on the chart. A bearish Engulfing setup could indicate the beginning of a new bearish move on the chart. Notice that the first candle of the pattern is bearish and it is fully contained by the body of the next candle, which is bullish. This creates the bullish Engulfing, which implies the trend reversal. A valid bullish Engulfing would be the beginning of a bullish move after a recent decrease. The market maker apparently chose to enter long at the daily demand area, which was their bullish order block.

The BSL SSL Trading Strategy is a stop loss hunter technique, allowing retail traders to avoid and find profitable entry locations. A strategic location for market makers to enter the market by placing an entry, after successfully breaking out the previous S/R. These additional signals provide traders with greater conviction before executing a trade.

Why I Quit Trying To Grow A Small Trading Account

The second candle opens at a similar level but declines throughout the day to close significantly lower. How to interpret the price manipulation around the engulfing bar. You’ll have to take profits along the way and scale-out of your position as the trend matures.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. The first candlestick shows that the bears were in charge of the market. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. Here are the key takeaways you need to consider when using the engulfing patterns. Engulfing patterns can produce false bearish or bullish reversal signals.

Unlocking the Power of the Bullish Engulfing Candle: A Key Signal for Forex Traders:-

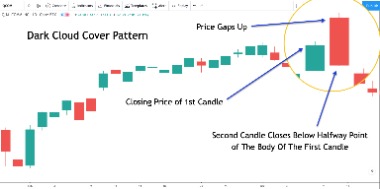

A trade can be opened in the resistance area after a bearish engulfing pattern and other candlestick patterns appear. The final target will be the buying area, i.e., the support level. Consider small time frames — 30 minutes and shorter — to find the optimum entry point. To identify support and resistance, you’d better use big time frames, from 4 hours and more. The picture below shows that the bulls failed to break through the key resistance level, and the first bearish engulfing pattern formed. Its peculiarity is a long red body after a short green body, which means the market participants fixed profits, and a bearish reversal occurred.

In this pattern, the most recent candlestick fully engulfs the body, high and low of the previous candlestick. The most recent candlestick will have red color while the previous candlestick will have a green color. Mapping daily untuk retracementFrom the daily chart view above, it can be seen that the downtrend on the daily TF has been exhausted after the BMS on the daily high.

This example comes from the 3-minute chart of the DAX futures listed on EUREX. The first bar in the chart below corresponds to the first three minutes of the session. But the bull move halted as a bearish Engulfing pattern emerged. This presents a wonderful chance to increase one’s financial standing.

Always be on the lookout for this pattern, and when you do spot it, make sure you capitalize on it. The target can be the height of the pattern or it can also be a fixed percentage or points based target depending on your research. Pay attention to the ongoing movement cycle on TF H4 and above, whether it is in the process of retracement or has reached the goal of re-entry in accordance with the prevailing trend. The second candle has a higher shadow top than the previous candle. The second candle has a lower shadow bottom than the previous candle. Stay on top of upcoming market-moving events with our customisable economic calendar.

Bullish Engulfing Candle: Meaning & Strategy

This engulfing candle strategy needs the low and high of the current candle to engulf the previous one and also in the example of a bullish engulfing close above the… The chart starts with a price increase which we have marked with the green arrow on the image. You will notice that the price action creates only bullish candles. Suddenly, we see a relatively big bearish candle, which fully engulfs the previous candle. This confirms the presence of a bearish Engulfing pattern on the chart.

Next, you need a valid entry trigger to get you into the trade such as the bullish engulfing candle. The first step in trading an engulfing pattern is recognizing the formation in real-time. To do so, look for patterns where a larger opposing second candle follows a smaller positive or negative candlestick.

How Did Macy’s Buck the Retail Trend and Raise 2023 Forecasts? – Nasdaq

How Did Macy’s Buck the Retail Trend and Raise 2023 Forecasts?.

Posted: Wed, 15 Mar 2023 07:00:00 GMT [source]

I have previously written about how to trade thebearish engulfing pattern, and as you might expect there are many similarities between the two. At times, an uptrend following the bullish engulfing candle excels the one that precedes the correction so that this pattern can be met with optimism. Some caution and accuracy in reading the charts are a must, as mistakes and carelessness can cost too much.

Tips on learning forex trading (en)

You could close a portion of the position here, and keep a portion open in anticipation of a further decrease in price. The yellow arrows on the chart show the size of the pattern and how it should be applied as a minimum target on the chart. This target gets completed with the next candle, which appears after the Engulfing confirmation. When this distance is fulfilled by the price action, you can either close the whole trade, or part of it. If you decide to keep a portion of the trade open, then you should carefully monitor price action for a potential exit opportunity. The previous candlestick has a red color, and the most recent candle has green color.

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

In the chart above, notice how the market bounced off the low of this Anchor Bar twice before continuing to push lower. The climactic bearish bar was an Anchor Bar, a price bar of exceptional range and volume. Consequently, such bars tend to exert influence over subsequent price action. The body of the second candlestick completely engulfs the body of the first candlestick. Should you put your money on the Bullish Engulfing Candlestick Pattern? Well, to find out, why don’t we test the Bullish Engulfing Pattern one hundred times, just like we tested other trading strategies multiple times on this channel.

This push above the first swing high contained a series of six bullish candlesticks, each closing above the high of the previous candlestick. The bullish momentum here was impressive and affirmed the upwards trend. These guidelines aim for a retracement entry using the Engulfing candlestick pattern after determining our trading bias with an analysis of swing pivots. An Engulfing candlestick in the proper context offers a solid trading setup.

The stop loss order for this trade should be located above the upper wick of the engulfing candle as shown on the image. When the conditions of engulfing candlestick meet, the indicator will highlight the pattern with white or black color. You can also change the color in the settings of the indicator.

This provides a positive https://g-markets.net/-to-reward ratio, maximizing potential profits while minimizing potential losses. The GBP/USD daily chart is a prime example of this strategy in action. By incorporating the bullish engulfing candle pattern into their trading strategies, forex traders can potentially achieve greater success in the markets. The bullish engulfing pattern is a strong candlestick formation used by traders to identify trend reversals. It occurs when a strong green candle engulfs the prior red candle body at the bottom of a downward trend. This signals a trend reversal to the upside, indicating that selling pressure has lost momentum at a key level.

Stay in the trade for a minimum price move equal to the size of the Engulfing pattern, or use price action rules to extend the duration of the trade. Combining Support and Resistance with the Engulfing pattern is an excellent price action based trading method. But I will advise you to manually check the trading setup instead of entirely relying on the indicator because every trade setup will not be winning. You should add other technical confluences to increase the winning probability of a trade setup.

Indicators such as the RSI, Bollinger Bands, and the ADX still have their place in trading. Professional traders always look at the price before anything else. Now, the first sign that buying the engulfing pattern is a bad idea was that we didn’t have enough profit margins.

This powerful reversal pattern can be used to trade stocks at market bottoms. The location of your stop-loss when trading engulfing candles is exactly the same as the position I showed you for trading pin bars. Although engulfing candlesticks come in various shapes and sizes,, how big an engulfing candle is has a dramatic effect on whether your trade will end up being successful or not.

The next step is to establish how to manage risk, i.e. where to hide our protective stop loss and when to exit the market. The natural flow of the price dictates that sooner or later we’re going to see an expansion in volume, which brings us to the second step. The apparent shift in the supply-demand balance is revealed by the second candle, which shows that the buyers have stepped in and managed to overcome the sellers. Or, a more conservative approach would be to wait for a candle close below the low. Rayner Teo is an independent trader, ex-prop trader, and founder of TradingwithRayner.