Contents:

ShipBob’s algorithm selects the fulfillment center you have inventory in that’s closest to the customer. As soon as the order ships,ecommerce order trackinginfo is pushed back to your online store and sent to your customers so they stay in the loop every step of the way. ShipBob’s technology powers our network of fulfillment centers across the country. As soon as an order is placed on your store, it is automatically sent to the ShipBob fulfillment center closest to the customer to be picked, packed, and sent to the customer. ShipBob makes it easy to take a data-driven approach to inventory distribution.

A DPO of 20 means that, on average, it takes a company 20 days to pay back its suppliers. With ShipBob’s network of nationwidefulfillment centers, you have access to a powerful geographic footprint. Our fulfillment centers are powered by our proprietary technology, which makes it easy to strategically split and manage your inventory toreduce shipping costsand time in transit. One easy way to sell more of a slow-moving product is to bundle it with a more popular item — especially if the two items naturally go together (e.g., shampoo and conditioner) — and offer the bundle at a discount. That way, you can move less popular items out while still recouping most of your initial investment in the inventory. With this knowledge, merchants can invest in inventory that will probably move quickly, and avoid or discontinue products for which there is little demand.

- Since Walmart is a retailer, it does not have any raw material, works in progress, and progress payments.

- Days in inventory is an important metric for understanding the health and efficiency of a business’s inventory management process.

- INVESTMENT BANKING RESOURCESLearn the foundation of Investment banking, financial modeling, valuations and more.

DIO is a very effective metric when analyzing the effectiveness of a company. There are two different ways to calculate the average inventory value that simply adjust the time span being measured. Days inventory outstanding is one of many critical business metrics that highlight the importance of inventory management in your larger operation. It’s another reporting tool with which to measure the overall health of your organization. In the annual report, the company reported the cost of sales of $163,756 million, opening an inventory of $4,855 million and closing inventory of $3,956 million.

A common misconception is that DII means how many days it takes to clear out inventory. This implies that if your DII is 40 days, then in 40 days you can expect to have sold everything in stock. That holds true if you only sell one type of product, but if you sell multiple products, DII measures the average turnover of inventory, in dollars.

Related Products

If suppliers give price breaks at certain volume thresholds, the cost of having more inventory on hand may be well worth the discount for buying more. If being out of stock even once could cause you to lose customers, you’ll be more likely to want extra inventory on hand. Days Inventory Outstanding is a vital KPI in Supply Chain Management that measures the amount of inventory supply that a company has on hand. For investors and other stakeholders, the fewer days of inventory on hand, the better. Management takes measures to streamline this part of the operation, so that the days of inventory are reduced to 30. The costs of holding inventory drop, and $100,000 in working capital is freed up for other uses.

The net factor gives the average number of days taken by the company to clear the inventory it possesses. Company Zing has an inventory of $60,000, and the cost of sales is $300,000. If a company has a low DIO, it is converting its inventory to sales rapidly – meaning working capital can be deployed for other purposes or used to pay down debt.

If your company has $1 million in cash reserves, then that money could be invested elsewhere instead of being tied up in inventory. The longer your company holds onto its products and resources, the more they are costing you in interest on those funds . High-quality demand forecasting can more accurately identify which products have been popular with consumers in the past, and which are most likely to sell in the upcoming season or sales period. Imagine a company has $25,000 in average inventory during a one-year period. To calculate days inventory outstanding, you will need to use the DIO formula.

Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. A short DIO means that inventory is converted to cash faster, while a high DIO indicates less liquid inventory. End-to-end Financial Close Automation to enable day-zero close with close task and project templates, automated workflow and close task management. Let’s take an example to understand the calculation of the Days Inventory Outstanding in a better manner. Both DSO and DPO are important metrics, but they provide different information.

Free Templates to Better Understand Your Inventory

Inventory is typically a merchant’s greatest investment and can tie up a great deal of capital. Simply choose the method that is most convenient based on the variables you have available from your ledger. Based in Atlanta, Georgia, William Adkins has been writing professionally since 2008. He writes about small business, finance and economics issues for publishers like Chron Small Business and Bizfluent.com.

revzilla promo code reddit march 2021 sales of inventory is a calculation used to measure the average number of days it takes a company to sell its inventory. All inventories, whether in the form of raw materials, work in progress, or finished goods, are considered. DSI concept is important in a company’s inventory management as it informs managers on the number of days the stock will last in the stores. Management, therefore, may find it beneficial to ensure that inventory moves fast to reduce costs and increase cash flows.

Thus, the days inventory outstanding figure can be misleading, depending on how a business chooses to use its inventory. Days inventory outstanding measures the average number of days required for a business to sell its inventory. A low days of inventory figure is generally considered to represent an efficient use of the inventory asset, since it is being converted into cash within a reasonably short time. In addition, a short holding period allows little chance for inventory to become obsolete, thereby avoiding the risk of having to write off some portion of the inventory asset. DIO is one of the most widely used activity ratios used to assess a company’s operation.

Days Sales in Inventory Example

For example, if your business is seasonal, an annual average might not be helpful. That means if you’re expecting something to happen that’s going to change your DII going forward, like a new supply chain or product launch, your historical DII is going to be less useful to planners. It can be tempting to order as much inventory as possible to take advantage of supplier discounts and drive down unit costs.

New-Vehicle Inventory Improves, Still Woefully Low. But Full-size … – WOLF STREET

New-Vehicle Inventory Improves, Still Woefully Low. But Full-size ….

Posted: Sun, 23 Oct 2022 07:00:00 GMT [source]

You have enough free cash flow available for investment and debt repayment purposes. The company is not storing enough inventory for the required demand, i.e. the company could be struggling to meet the sudden increase in demand. It maximizes sales and profit margins because customers are more likely to buy a product that is available now than one that will be available in the future. Days payable outstanding is a ratio used to figure out how long it takes a company, on average, to pay its bills and invoices.

DSI is calculated by dividing the average inventory by the cost of goods sold. Okay now let’s dive into a quick example so you can understand clearly how to calculate the average inventory days of a firm. Having a small inventory days on hand naturally means that you are holding less stock — and when you hold less stock, you have more freedom to pivot and cater to shifting customer demands. While businesses generally strive to achieve a high inventory turnover, they typically want a lower inventory days on hand. There are several advantages to having a lower inventory days on hand, which can benefit your business and your bottom line.

Too much https://bookkeeping-reviews.com/ tied up in inventory can cause problems elsewhere, such as the inability to pay a supplier on time or invest in a new opportunity because all your money is tied up in inventory. Monitoring DII can help prevent those kinds of issues from happening. Obsolete inventory, or inventory that can no longer be sold due to lack of demand or relevance in the market, can be a major drain on resources. Carrying excess inventory always increases the chance of obsolescence.

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling. A company’s inability to swiftly convert its inventory into sales is indicated by a high number of days inventory outstanding. Poor sales results or the procurement of excessive inventory may be to blame in these cases. Last, but not least, it is worth noting that DIO does not give you the whole picture of the company’s operation.

Cash Forecasting Software

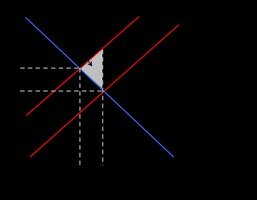

The formula for inventory turnover is the cost of goods sold divided by the average inventory balance. For purposes of forecasting, inventory is ordinarily projected based on either inventory turnover or days inventory outstanding. The concept of inventory turnover is closely tied to DIO, as inventory turnover refers to how often a company’s inventory balance needs to be replenished (i.e., “turned over”) each year. The average inventory turnover and DIO varies by industry; however, a higher inventory turnover and lower DIO is typically preferred as it implies the management of inventory is closer to an optimal state. The formula for calculating DIO involves dividing the average inventory balance by COGS and multiplying by 365 days. NetSuite Inventory Management helps businesses monitor and track their inventory.

The most common way to derive an average inventory figure is to take the average of the beginning and ending inventory balances for the measurement period. A more accurate option is to include in the average the ending inventory balance for every day of the measurement period. Days inventory outstanding, or DIO, is a measure of how quickly a company can turn its inventory into sales. The days inventory outstanding definition is the average time it will take for the company to sell its inventory to its customers or clients. The average days inventory outstanding depends on the nature of the product and the industry. In general, a lowers number is preferred as it indicates the funds are tied up in the company’s inventory for a shorter period of time.

James now wants to find his DIO for his store, as well as, select product lines. DIO is helpful for inventory forecasting to avoid overstocking or under-stocking. If you decide to reorder your inventory without considering DIO, you may end up investing too much in your stock and not have enough cash on hand. Additionally, a brief holding time reduces the likelihood that inventory will become outdated, lowering the possibility that the inventory asset would need to be written off as a whole. Because it converts to cash in a reasonable amount of time, whereas an increase indicates a decline. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

- Monitoring DII can help prevent those kinds of issues from happening.

- Even if a customer doesn’t use it, they will probably enjoy the surprise, which can even boost customer loyalty.

- On the other hand, the Average Days to Sell the Inventory metric is calculated by dividing 365 by the Inventory Turnover Ratio.

- With fewer stockouts, you can ensure a consistent customer experience and prevent backorders.

The total dollar value of the inventory-on-hand divided by the average cost of goods sold per day. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.