Content

And as she hesitated between obedience to one and duty toward the other, her life, her love and balance sheet definition was in the balance. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

What is a balance sheet?

A balance sheet gives information on a business’s value at a certain point in time. It shows how much the company owns (assets) or owes to others (liabilities).

Securities and real estate values are listed at market value rather than at historical cost or cost basis. Personal net worth is the difference between an individual’s total assets and total liabilities. Accountants and corporate finance teams are responsible for making balance sheets and other financial statements like cash flow statements.

What Are the Uses of a Balance Sheet?

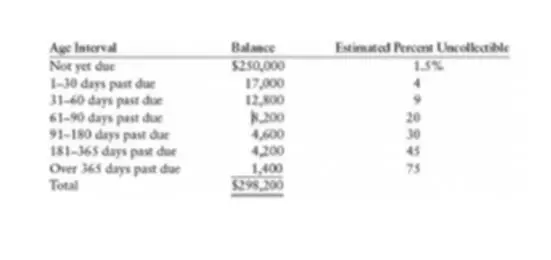

Last, a balance sheet is subject to several areas of professional judgement that may materially impact the report. For example, accounts receivable must be continually assessed for impairment and adjusted to reflect potential uncollectible accounts. Without knowing which receivables a company is likely to actually receive, a company must make estimates and reflect their best guess as part of the balance sheet. Current portion of long-term debt is the portion of a long-term debt due within the next 12 months. For example, if a company has a 10 years left on a loan to pay for its warehouse, 1 year is a current liability and 9 years is a long-term liability.

Additionally, a company must usually provide a balance sheet to private investors when planning to secure private equity funding. Activity ratios mainly focus on current accounts to reveal how well the company manages its operating cycle. Financial strength ratios can provide investors with ideas of how financially stable the company is and whether it finances itself. The company retained $331 in earnings during the reporting period, greatly less than the same period a year prior. The liabilities of the company total $30,548, including $19,705 in current liabilities and $10,843 in noncurrent liabilities.

Balance sheet – definition and meaning

Investors can use the balance sheet to calculate a number of metrics that will help them better understand a company’s performance and financial situation. Current assets are those that could be converted into cash within 12 months and include things like inventory and accounts receivable. In modern accounting terms, they are a combination of a profit and loss balance sheet and an income and expenditure report. A balance sheet shows what the company owns and owes to others at a certain point in time.